Having quickly learned the limitations of the Morningstar (M*) rating system I find myself now leaning towards other criteria. We showed in previous post that a one star rated stock can appreciate as readily as a five star rated stock.

Anyway -this post is more of a notepad ...I've been screening stocks and figured I could keep some of the data blogged here.

I did a basic screen to look for companies with a wide Economic Moat and Low Risk. That screening resulted in 59 companies.

as an aside - the S&P 500 holds over 1/5th of it's stocks in the Financial Services Sector - 21.39% according to M*.

My Taxable Portfolio contains 4.22% in the financial industry which is due to Alleghany (Y) and Wilmington Trust (WL) - Alleghany is set up for automatic monthly purchases via

SoGoInvest.com and Wilmington is a DRIP (absolutely NO fees!) which I recently set up for automatic monthly purchases. I'd like to add Bank of America (BAC) and in a practice portfolio I had analyzed, I also added Nuveen Investments (JNC), Blackrock (BLK) and Student Load (STU) then equalized my holdings and found that adding those three financial stocks (w/ equal weighting) would bring my exposure to the Financial Sector up to 21.40% - so, six companies among the financial industry which would make up 21.4% would mean about a 3.56% exposure per each of the six companies - cash and two high yield bond funds would make the exposure around 3.23%.

Found some interesting things - I like to look at the number of years a company has had increasing revenues year after year and maintained positive earnings per share.

When I did a screen looking for Financial companies w/ 10 years of increasing revenues, some sort of economic moat (either narrow or wide) along with low risk I end up with 7 companies - three of which I've already mentioned - namely Nuveen Investments (JNC), Student Loan (STU) and Wilmington Trust (WL).

If we change the criteria from Low Risk to anything of Average Risk or lower, we then get 41 companies returned which also includes Eaton Vance (EV)

Now, we'll take a cursory look at the star rating along with a few other attributes;

Blackrock (BLK) - 1* - Mid Growth - Aggrestive Growth - BA Risk

Eaton Vance (EV) - 3* - Mid Growth - Classic Growth - Ave Risk

Nuveen (JNC) - 3* - Mid Growth - Classic Growth - BA Risk

Student Loan (STU) - 5* - Mid Core - Classic Growth - BA Risk

Wilmington Trust (WL) - 3* - Mid Value - Slow Growth - BA Risk

Bank of America (BAC) - 4* - Large Value - High Yield - Ave Risk

Alleghany (Y) - 4* - Mid Core - Speculative - Ave Risk

There has been an intentional look into the Non Large Cap stocks ...

Of those stocks mentioned above

EV, JNC, STU & WL all fall into the 10 years screening of increasing revenues & positive earnings.

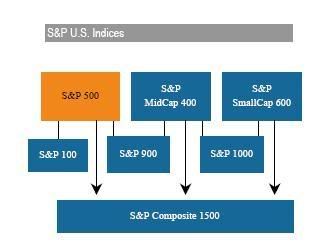

Perhaps somewhat of a developing theory but, the initial criteria for a stock to be considered in the S&P 400, is that it's market cap should be in a range of 1 - 4.5 billion dollars while initial inclusion into the S&P 500 is for market caps in excess of 4 billion dollars. We may note however, that all of the top 10 companies in the S&P 400 are well in excess of the initial criteria of 4.5 billion so, there is forward thinking that if a company in the S&P 400 continues to grow that it will eventually be moved to the S&P 500 which has much greater exposure to the buying public and, as such, would be very positive for stock price growth.

I know Cognizant Technology Solutions (CTSH) was the top market cap stock in the 400 but was recently moved to the 500. After CTSH we have Peabody Energy and Expeditors International (EXPD) as top holdings - and, as fate would have it - I own EXPD.

Looks like CTSH was changed on 11/13/06

btw - BLK, EV and JNC all have 1, 3 & 3 stars respectively but what I am more emboldened with now is the change in their Fair Value Estimate (fve) - here's how that's changed for each company over the past 5 years

BLK - fve raised 10x since Nov '03

EV - fve raised 10x since May '03

JNC - fve raised 10x since Jan '03

The best part about the fve provided by M* is that the market has concurred and stock prices have risen along with the M*'s fve.