S&P Indices - Part 2

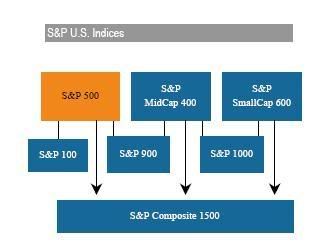

Now that we have an overall view of the S&P Indices for Large, Medium and Small companies we will now consider the other basic four Indices which are simply derived from the first three. Afterwards we'll show the top 10 holdings and sector allocation for the S&P 500, 600 & 400.

S&P 100

The S&P 100, often known by its ticker symbol OEX, measures large-cap company performance. This market capitalization weighted index is a subset of the S&P 500, and is made up of 100 major, blue chip companies across diverse industry groups.

S&P 900

The S&P 900 is a combination of the already widely used S&P 500 and S&P MidCap 400 indices, where the S&P 500 represents approximately 92% of the index and the S&P MidCap 400 represents 8%. The combination of these two indices addresses the needs of those investors who wish to allocate assets to a broader large-cap universe, beyond the S&P 500.

S&P 1000

The S&P 1000 is a combination of the already widely followed S&P MidCap 400 and S&P SmallCap 600 indices, where the S&P MidCap 400 represents approximately 70% of the index and the S&P SmallCap 600 represents 30%. The combination addresses the needs of investors who want to allocate assets between large capitalization stocks and the rest of the investable market.

S&P Composite 1500

Combining the S&P 500, S&P MidCap 400, and S&P SmallCap 600 indices is an efficient way to create a broad market portfolio representing 90% of U.S. equities. This combination addresses the needs of investors wanting broader exposure, beyond the S&P 500. The S&P Composite 1500 is gaining ground amongst plan sponsors as an effective measure of the U.S. equities market.

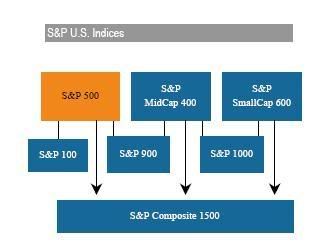

S&P 100

The S&P 100, often known by its ticker symbol OEX, measures large-cap company performance. This market capitalization weighted index is a subset of the S&P 500, and is made up of 100 major, blue chip companies across diverse industry groups.

S&P 900

The S&P 900 is a combination of the already widely used S&P 500 and S&P MidCap 400 indices, where the S&P 500 represents approximately 92% of the index and the S&P MidCap 400 represents 8%. The combination of these two indices addresses the needs of those investors who wish to allocate assets to a broader large-cap universe, beyond the S&P 500.

S&P 1000

The S&P 1000 is a combination of the already widely followed S&P MidCap 400 and S&P SmallCap 600 indices, where the S&P MidCap 400 represents approximately 70% of the index and the S&P SmallCap 600 represents 30%. The combination addresses the needs of investors who want to allocate assets between large capitalization stocks and the rest of the investable market.

S&P Composite 1500

Combining the S&P 500, S&P MidCap 400, and S&P SmallCap 600 indices is an efficient way to create a broad market portfolio representing 90% of U.S. equities. This combination addresses the needs of investors wanting broader exposure, beyond the S&P 500. The S&P Composite 1500 is gaining ground amongst plan sponsors as an effective measure of the U.S. equities market.

0 Comments:

Post a Comment

<< Home